Get the Flood Facts

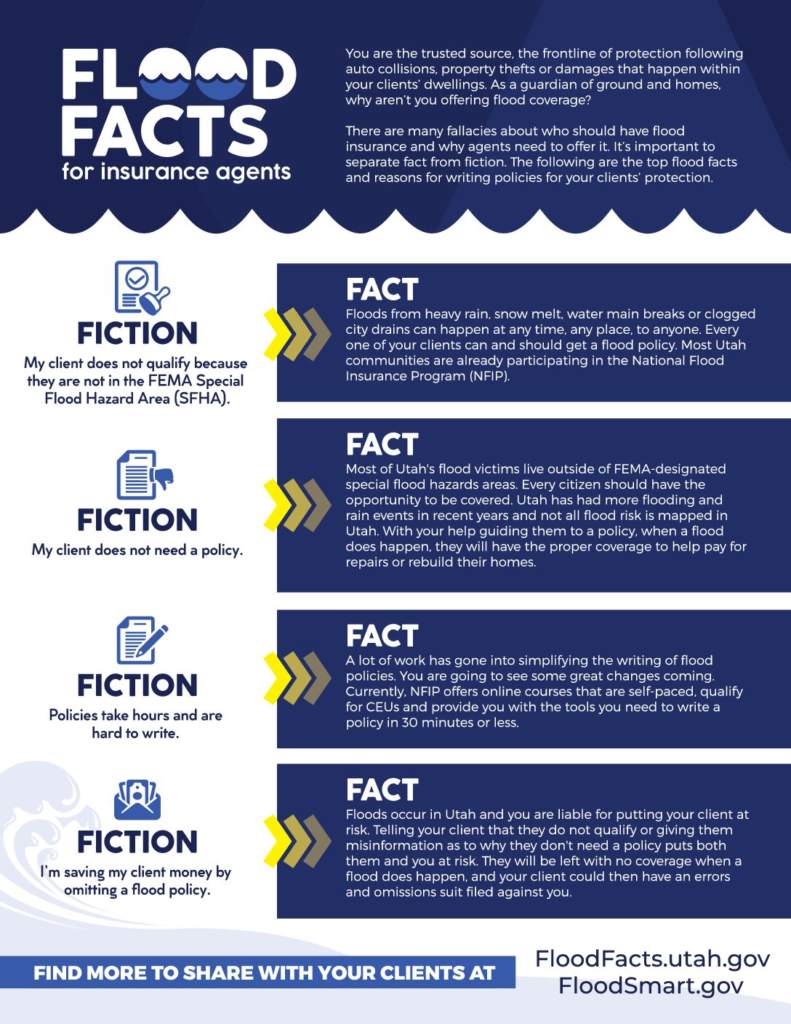

You may think you’re already protected against flood damage, but you’re probably not. Flooding is the most common natural disaster in Utah, yet most homeowners and renters aren’t properly covered. Get to know the facts about flood insurance and get protected.

Click on the images below to access FEMA Flood Facts documents – Click here for PDFs of each

HOME OWNERS INSURANCE ONLY COVERS PIPE BREAKS INSIDE YOUR HOME

Flooding caused by storms, melting snow, hurricanes, water backup due to inadequate or overloaded drainage systems and broken water mains from outside the home are not covered by most homeowners and renters policies.

ONE INCH OF WATER CAN CAUSE $25,000 WORTH OF DAMAGE

Repair costs really add up once you’ve done what’s necessary to replace your personal possessions, carpet, drywall, and insulation. To prevent toxic black mold and eroding foundations, repairs must be made to code.

EVEN HOMES OUTSIDE OF DESIGNATED FLOOD PLAINS ARE AT RISK

You do not need to live near water to experience flooding. More than 40% of flooding in Utah in the past few years has been outside of the Special Flood Hazard area. Utah has had more flooding and rain events in recent years and not all flood risk is mapped in Utah. Click below for Utah’s floodplain mapping program.

FEMA INDIVIDUAL ASSISTANCE AVERAGES LESS THAN $8,000

The value of flood insurance is much higher than the cost. Buy flood insurance before a flood happens, otherwise you won’t be covered.

97% OF UTAHNS DON’T HAVE PROPER FLOOD INSURANCE

Flood insurance policies typically take 30 days to go into effect. If you wait to purchase a policy until after a flood event threatens or occurs, your property won’t be protected from the damage caused by that flood event.